The study of behavioral finance has its roots in cognitive psychology, a branch of psychology that deals with our internal mental processes. Cognitive psychology views emotion as a product of our evaluation of an event, and it has been shown that our emotional responses can affect our financial decision making, leading to biases and inefficiencies. Behavioral finance seeks to identify these inefficiencies and biases. Ultimately, it aims to provide a framework for analyzing market returns in hindsight.

Behavioral finance is a subfield of behavioral economics

The study of how people make financial decisions is based on principles of economic psychology, and this field is largely influenced by this research. This subfield of behavioral economics focuses on the psychological aspects of investing. It reveals that investors often behave in ways that are different from rational expectations. Using this information, financial professionals can make more rational financial decisions. Here are some of the main concepts behind behavioral finance.

Behavioral finance is a relatively new subfield of economics, but it has attracted the attention of economists and neuroscientists alike. It attempts to understand the psychological forces that cause market prices to diverge from their fundamental values. A basic introduction to this field will provide an overview of behavioural economic theories, empirical research, and strategies for correcting irrational financial behavior. The course will also introduce students to some of the most important concepts in this field.

It examines psychological influences on investors

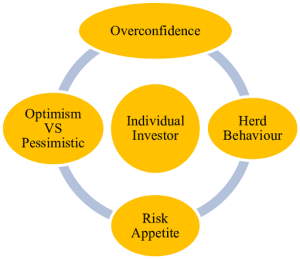

Behavioral finance is the study of the psychological influences on investors and their financial decisions. Its main goal is to understand why we behave in certain ways and to determine which factors can affect our choices. There is a wide variety of research that shows that individuals behave differently based on their emotional state and cultural background. Psychologists are now studying the impact of cultural factors on financial decisions and investing. The results show that investors from Scandinavia and Germany are more patient than their counterparts in Asia and the Middle East.

Also Read: Popular Crypto Exchanges

Behavioral finance studies the psychological influences of investors to determine why certain behaviors are more likely to result in better investment choices. For instance, research has shown that individuals’ risk perceptions and tolerances are influenced by their personality, and that these reflections influence their behavior. In addition, the study has shown that the importance of emotional intelligence and financial literacy is significantly related to investment decisions. Behavioral finance studies the relationship between financial risk taking behaviors and these variables.

It identifies inefficiencies and mispricing in financial markets

Behavioral finance is a branch of economics that explores the psychological biases of investors and traders. It attempts to identify these biases, which are often responsible for market inefficiencies. In this branch of finance, researchers are able to better predict market movements and prices by analyzing these biases. Behavioral finance is a useful tool in predicting market returns, although it is not a substitute for a comprehensive understanding of the market.

Market efficiency refers to how accurately market prices reflect all available information. If markets are highly efficient, the price of a given security reflects all of the available information and represents the true value of that asset. If a market is highly inefficient, investors are more likely to follow their own advice than make an informed decision. Mispricing is a common result of market inefficiency.